Over the years, technology has evolved, and the online payment system has revolutionized how we conduct financial transactions.

66% of adults worldwide use digital payment methods to transfer and receive money

There is no wonder why more than half of the world’s population relies on online payments. With just a few clicks, individuals can make purchases, pay bills and transfer money without fearing losing time. Ease, convenience, and speed are the few factors that make online payment gateway appealing to customers.

However, since the e-commerce boom, because easy online payments provide various consumer benefits, it also comes with security risks involving theft and fraud.

In 2022, E-commerce losses to online payment fraud were estimated at $41 billion worldwide, marking an increase from the previous year.

It’s significant to understand how an online payment system benefits you, but it is also crucial to identify the risks that online payment easiness brings. To simplify your search, we bring you the benefits and risks of an online payment gateway under one umbrella. Hold on tight and brace yourself for an in-depth exploration of the benefits and risks of using online payment.

What is Online Payment, And Why is it Important?

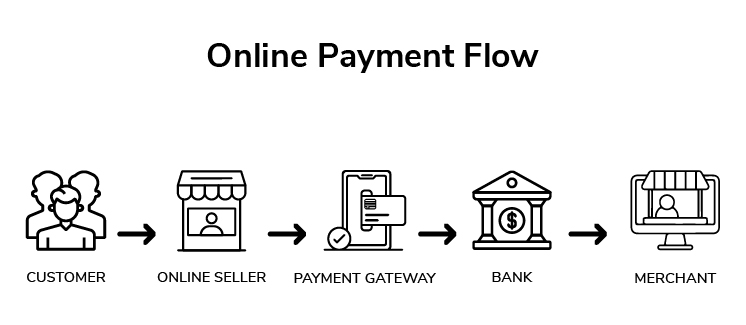

Online payment is not a luxury but a necessity that lets users make transactions and purchases worldwide 24/7. If we go for an exact definition, it goes as a transfer of funds via the Internet through a third-party payment processor.

Around 2 billion people worldwide don’t have access to traditional banking services (Worldbank)

By seeing the number, you can ensure the need for an online payment system. It solves this problem by allowing individuals to conduct financial transactions without needing a physical bank.

Rise of e-commerce and the increasing number of people using mobile devices, online payment has become more critical than ever. It offers a level of convenience that traditional payment cannot match. The importance of an online payment system cannot be overstated, as it plays a key role in the life of consumers and also in the success of businesses

Benefits and Risks Involved in Using Online Payment System

Where online payment guarantees convenience in transferring funds and purchasing, it also comes with numerous benefits that are impactful enough to persuade someone to use online payment gateways. However, some risks in online payment can never be addressed. Let’s explore:

– Benefits of Using Online Payment

Online payment offers a variety of fruitful benefits that are worth considering. Some of the profitable benefits of online payment systems are:

- Convenience & Accessibility

Imagine you are a reseller who wants to purchase in bulk for your business, but your payment gets stuck because of traditional banking service. The chances are high of losing your customers. Yes, being unable to make payments can be a nightmare.

That’s where online payment systems show the benefit of completing transactions with easy convenience and accessibility. You can make online payments anytime, anywhere, regardless of time, location, and device. For example, an API customization service for your e-commerce store lets you offer all significant payment gateways offered by API experts to your customers and enjoy convenient transactions. This customization makes online payment easy for your customers and allows your business to achieve immense success.

- Increased Security & Fraud Protection

The other significant benefit of using online payment gateways is better security and fraud protection. Since the rising of the online payment tradition, the risk of fraud and data breaches has also increased.

Many payment gateways like WP EasyPay implemented various measures to minimize this threat to protect user information and let customers complete transactions without any security breach or fraud. Also, many online payment systems come with fraud detection tools that can quickly identify suspicious activities and notify users of potential fraud. These secure and fraud-free online payment gateways benefit customers and businesses in the same ways as it minimizes the chances of financial losses.

- Faster Transactions with Lower Costs

But since online payment transfers the fund’s gateways, the transaction becomes faster at a lower cost.Online payment systems allow instant transaction processing that lets the funds be transferred in seconds.

Also, online payment has lower transaction fees than other mediums. For example, a wire transfer can cause up to $0-$50 per transaction, while a credit card processing fee can be up to 3%. Whereas an online payment system often has very low to minimal fees, making it an attractive option for businesses looking to save on transaction costs.

– Risks of Using Online Payment

While an online payment system offers many benefits, it also comes with certain risks that users must be aware of. Some of the risks that need your attention are

- Security Concerns & Data Breaches

One of the significant risks associated with an online payment system is security and the potential for data breaches. With online payment, sensitive financial and personal information, such as bank account details, credit/debit card numbers, and personal numbers & addresses, are transmitted over the Internet. This leaves the data vulnerable to cyber criminals who may try to breach the data and use it for fraudulent activities.

Also, phishing scams and other fraud techniques are becoming increasingly sophisticated, making it more difficult for users to spot fraud.

- Technical Glitches & Errors

Online payment systems must be more capable of catering to technical glitches and errors that can lead to failed or incorrect transactions. Technical glitches and errors can occur due to diverse factors like network failure, server downing, and bugs in the payment software.

To mitigate the risk of glitches and errors while making online payments, businesses should opt for an online payment system with proper quality assurance and testing procedures to ensure the system functions correctly.

- Potential for Payment Disputes & Chargebacks

Regarding online payment systems, convenience and speed are undeniable factors. However, what can change these benefits in utter risk is the potential risk of payment disputes and chargebacks. It can arise for various reasons, like fraud, error, or dissatisfaction with a product/service.

Disputes can be costly for both businesses and consumers. Chargeback results in damage to reputation and lost revenue. It can lead to customer frustration because of the long process and the deterioration of payment systems. To minimize this hassle of dispute and chargeback.

Conclusion

Online payments have become a significant part of daily life and an essential component of e-commerce, making it easier for customers to shop and for businesses to process transactions. Along with a myriad of benefits, many risks are also involved.

To minimize the risks involved with online payments, businesses should use secure, reliable & transparent payment gateways like WPFormify, making it easy for businesses to receive payments. Despite the risks, online payment systems are becoming increasingly popular and are essential in changing the troubled payment process into a smooth journey.