Every store owner tries to stay updated to beat the competitive market when the e-commerce market achieves an unbeatable score of operating businesses. But sometimes, lack of technological advancement and outdated payment processing systems lead businesses toward loss.

By 2023, the e-commerce market is expected to achieve a total value of $6.3 trillion globally.

To minimize the chances of losses, businesses need a reliable payment processor that enhances user experience, streamlines operations, and boosts revenue. However, when there are many options available, picking the right one can be challenging because if you get the wrong one, you may face a lot in terms of lost sales, damaged reputation, and dissatisfied customers.

That’s why we bring the two best payment processing solutions that meet your specific needs, i.e., Square & SumUp. But no business can implement both solutions. To clear your confusion and help you get the best one, we will comprehensively compare SumUp vs. Square, exploring their first-class features, features, experience, and many more.

What are Square & SumUp?

Square and SumUp are competitive payment processing systems with various functionalities and benefits.

Square

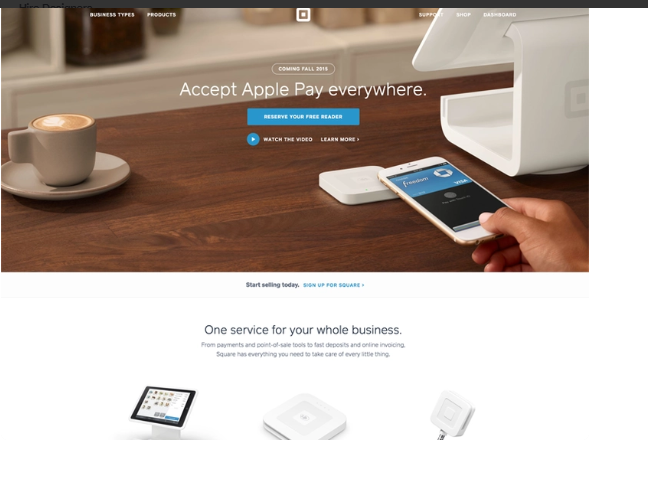

A payment processing solution that has gained immense popularity in recent years. It is known for its user-friendly interface, cost-effective pricing plans, and impeccable features. It allows businesses to accept payments through debit and credit cards, mobile payments, and online transactions. It provides tools compatible with mobile, retail & online sales.

SumUp

A fast, secure, and reliable payment processing method that allows businesses to accept payments anytime, anywhere. It is designed with a user-friendly interface that allows businesses to start quickly and provide different payment modes, including mobile & online payments and credit and debit cards. Also, its top-rated tools and features make the business efficient enough to handle payment operations effectively.

Pros and Cons of Square

Square has become a go-to solution for many businesses looking to streamline their payment processing operations. However, like other services, it also has pros and cons that businesses must consider before choosing Square.

Pros

- User-friendly interface

- Range of payment options

- Seamless integration

- Quick deposits

- Flexible invoicing

- E-commerce capabilities

- Fraud protection

Cons

- Limited customer support

- Lack of Customization

- Freeze account if irregular activity

- High-risk businesses restrictions

- Not ideal for high-level transactions

Pros and Cons of SumUp

Although many businesses, entrepreneurs, and freelancers count SumUp as the top payment processing solution. However, it has many benefits and limitations that one must weigh before opting for it.

Pros

- Low transaction fee

- Compatible with POS system

- Easy set-up process

- Mobile app available

- Accept various payments

- Quick deposits

- Contactless Payment

- Multi-lingual support

Cons

- Doesn’t support high-risk customers

- Limited hardware options

- No live support

- Need to apply separately for virtual terminal

- Offer minimal features

Comparison of SumUp and Square

When it comes to payment processing solutions, the two names that are often mentioned are Square and SumUp. With their excellent service and practical functionality, both earned a great reputation among every size of business, entrepreneurs, and freelancers.

Significant differences in both payment processing systems need to be addressed. We compare Square Vs. SumUp is based on diverse factors.

1. Pricing

The first significant difference that makes both payment processing solutions different from each other is their pricing structure. SumUp charges 2.75% for in-person transactions, 2.90 + 15¢for online transactions, and 3.25% + 15¢for transactions made with a keyed-in card.

On the other hand, Square charges 2.6% + 10¢for the transaction made with swiped or dipped card, 2.9% + 30¢for online transactions, and 3.5% + 15¢for keyed-in-card. So in Square vs. SumUp fees, SumUp is the one that is generally cheaper for businesses that process a large number of transactions, especially those with higher-value cards.

2. Payment Processing

Both Square and SumUp offer diverse payment processing modes, including credit cards, debit cards, and contactless payments. Square has its invoicing app, but SumUp also offers invoicing features that allow businesses to generate and send invoices directly to consumers.

However, SumUp doesn’t have recurring billing functionality, while Square does. The plus point that Let Square gets a winning position compared to SumUp vs. Square is chargeback protection and fraud prevention, which SumUp does not offer.

3. POS System

The POS system is the additional benefit that both Square and SumpUp offer in comparing Square Vs. SumUp, Square POS is more in demand because of its feature-rich compatibility, offering advanced inventory management, staff handling, and reporting options.

However the SumUp POS system is basic and offers all the essential features a business needs to handle sales and inventory.

4. Card Reader

In Square Vs. SumUp, if we compare both payment processing platforms based on card reader availability, then both offer this functionality. One works independently, while the other needs an app to complete its operation.

SumUp air reader is a mobile-based card reader that connects with a smartphone or tablet with the help of a downloaded SumUp app. It accepts all major credit and debit cards and contactless payments, including Google Pay & Apple Pay. It’s an easy-to-use, low-cost, and fixed-rate machine that is also easy to carry around with you on the go. Also, it has a keypad for pin entry and accepting a chip.

The square reader can also connect with a smartphone or tablet with the help of Bluetooth. It allows you to accept contactless cards, Apple Pay, and chip cards. But in the square reader, you don’t get the facility of a physical keypad, so customers need to use their phone or tablet to enter a PIN in the app.

Which One to Choose: SumUp or Square?

Upon conducting a comprehensive comparison of the SumUp vs. Square payment solution, it turned out that both provide businesses with an outclass of services with good benefits and functionality.

SumUp emerges as a profitable solution for businesses dealing with higher-value cards and a significant transaction volume. In contrast, Square offers many features with additional functionality like chargeback protection, recurring billing, and a feature-rich POS system.

Depending on other factors like processing fees, pricing, functionalities, and others, both Square and SumUp have something to offer their customers. So choosing one can be difficult. So to determine the best payment solution, businesses should evaluate SumUp Vs. Square based on their needs and requirements.

However, this strategic evaluation of Square Vs. SumUp can advise you that it depends on the few features that make SumUp the first choice for small, onsite businesses, whereas Square can help any e-commerce business to skyrocket its sales.

Conclusion: SumUp vs. Square

In 2023, when technology and businesses continuously evolve, payment processing solutions are also evolving. Therefore, businesses must monitor which one is trending and demanding in 2023. Our ultimate comparison of Square vs. SumUp will help you to simplify your decision to choose the best option for your business.

The above comparison indicates that both are equally profitable and good choices for any business but still hold some differences and diversity based on feature and operational efficiencies.

Frequently Asked Questions

- What is the main difference between Square and PayPal?

The main difference between Square and PayPal lies in their primary focus and core services.

Square focuses on point-of-sale solutions for businesses, while PayPal is primarily an online payment platform for money transfers and online transactions.