There is no denying that physical wallets are becoming a thing of the past. As a result, you do not need to carry cash or credit cards anywhere to purchase your preferred products or services.

You can purchase instantly using your smartphone or smartwatch through mobile payment apps.

As mobile payment options have become a new normal, Apple Pay, Google Pay, and Samsung Pay all these three digital services have revolutionized the entire online payment mechanism worldwide.

This exclusive guide will discuss Apple Pay, Google Pay, and Samsung Pay in detail.

So, without further ado,

Let’s start this extensive Apple Pay vs Google Pay vs Samsung Pay guide.

Apple Pay vs Google Pay vs Samsung Pay (Comparison)

|

Apple Pay |

Google Pay |

Samsung Pay |

|

|

Availability |

83 countries globally | 75 countries globally |

29 countries globally |

|

Supported Devices (Compatibility) |

Apple iPhone, Apple Watch, MacBook, iPad, Pro with TouchID, iPad Pro and iPad Mini | Android phones with NFC and HCE support | Samsung Galaxy phones, Gear S2 and S3, and other smartwatches |

|

Uses |

Supports in-app purchases, NFC terminals, and Safari (web purchases allowed) | Supports in-app purchases, NFC terminals, and web purchases |

Supports NFC terminals, in-app purchases, EMV terminals, and magnetic stripe |

| Integration with other platforms | Apple Pay can be integrated with its companies like Siri | Google Pay can be integrated with Google Maps and Google Assistant |

Samsung Pay can be integrated with services like Bixby |

|

Authentication |

Fingerprint or FaceID | Fingerprint, PIN, pattern, or password | Fingerprint, iris, or PIN |

| Cards | Debit, credit, and loyalty cards | Debit, credit, gift, and loyalty cards |

Debit, credit, gift, and loyalty cards |

|

Suitable for |

Apple users | Android users | Samsung users |

| Standout Features | Versatility | Peer-to-peer payments |

Accepts NFC and magnetic stripe |

Apple Pay

Apple Pay primarily works as a digital wallet, enabling you to replace your cash and physical cards comprehensively. Through Apple Pay, you can make transactions online and purchase products or services hassle-free.

Supported Devices: Apple Pay supports many iOS devices, including iPhone 6 and above, iPads, and all Apple Watches.

Security: From a security perspective, Apple Pay is a secure payment service. The service relies on a token system that generates virtual account numbers. Likewise, it generates a unique security code every time you make a transaction. Apple Pay does not store users’ card numbers.

Where can we use Apple Pay? You can trouble-free use the service at GAP, Starbucks, Panera Bread, and other leading stores. Moreover, numerous payment providers and banks accept Apple Pay from users.

Where it stands out: Apple Pay is a versatile payment service, as you can use the Safari browser to make online purchases.

You should use Apple Pay if you are willing to use an excellent mobile payment app that works well with advanced technology. iPhone, Apple Watch, and Apple users should consider availing of this option.

Google Pay

Google Pay, previously called Android Pay, is the official payment service. You can use it for peer-to-peer payments and buy various services at merchant terminals that assist NFC.

Supported Devices: If your device supports Android Lollipop (5.0) or above, you can use Google Pay.

Security: Google Pay also depends on token systems like Apple Pay for improved security. Furthermore, the service does not share its users’ card details.

Where can we use Google Pay? You can use it at different retailers and stores. It supports various banks and payment providers.

Where it stands out: Peer-to-peer payment facility is the standout feature of Google Pay.

Google Pay is suitable for all Android devices. It enables you to send money to your loved ones.

Samsung Pay

Samsung Pay, also called Samsung Wallet in a few countries like the US, UK, Germany, Spain, Italy, and France, is another impressive mobile payment app like Apple Pay and Google Pay. It has become a part of the Samsung Wallet.

You can use it on your Samsung Galaxy devices and a few Samsung wearables.

Supported Devices: You can use Samsung Pay on all Galaxy devices. Likewise, the app is compatible with wearable devices like Gear S2 Classic, Gear Sport, etc.

Security: Samsung Pay also relies on token systems like Apple Pay for secure transactions.

Where can we use Samsung Pay? You can use Samsung Pay on popular payment networks like Mastercard, Discover, American Express, and Visa.

Where it stands out: The app supports NFC and works exceptionally well with magnetic strip pay.

If you are a Samsung fan and want to buy your favorite products from any store, Samsung Pay should be your preferred choice.

Apple Pay Pros

- Offers a user-friendly app

- Supports numerous payment providers

- Allows users to use debit and credit cards

- Supports contactless payments

- Available in all the leading countries globally

Apple Pay Cons

- It does not support other platforms.

Apple Pay Presence Worldwide

Apple Pay is a prominent digital service powered by Apple Inc. This is why the service is available on different continents globally. These various continents are Africa, Asia-Pacific, Europe, the Middle East, Latin America, the Caribbean, and North America.

Google Pay Pros

- Supports all Android devices

- Compatible with Material You

- Supports contactless payments

- Enables users to add debit and credit cards, gift cards, and loyalty cards

Google Pay Cons

- Google collects users’ data.

Google Pay Presence Worldwide

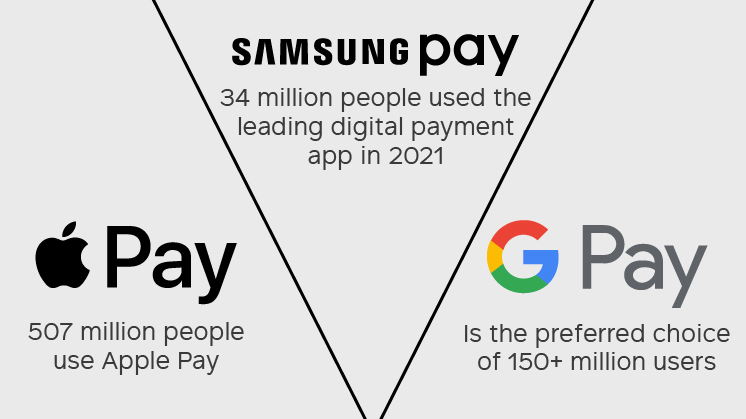

Google Pay has a presence in all the major countries throughout the world. The service has a fanbase of 150 million users, of which 25.2 million belong to the U.S.

In addition, users can access the services of Google Pay, formerly called Google Wallet or Android Pay, on a limited scale in certain countries. For instance, China has banned the different services offered by Google.

Samsung Pay Pros

- Users can make payments swiftly.

- Strong security is a huge plus.

- Supports contactless payments

- The app has an engaging user interface.

Samsung Pay Cons

- It only supports Samsung Galaxy phones and wearables.

Samsung Pay Presence Worldwide

Samsung Pay is also present in all the leading countries across the globe. Currently, the platform offers services in six (6) continents, including North America, Europe, Asia, South America, Africa, and Oceania.

Besides, you can access Google Pay or G-Pay in 24 markets, such as Singapore, the U.S., Spain, China, South Korea, Puerto Rico, Brazil, Australia, Switzerland, the U.K., Vietnam, Mexico, Italy, South Africa, and Canada.

Does Apple Pay charge any transaction fee?

Apple Pay does not take any charges when users buy any product or service through cards or mobile payments. That said, the card issuer may charge them any fee, and the exact charges are also applied to Apple Pay payments.

Does Google Pay charge any transaction fee?

When you make purchases through Google Pay using Google services like Google Play or Google Drive, you pay for your purchases, delivery fees, and applicable taxes.

When using Google Pay with credit cards, you do not have to pay additional fees. It means you would bear the same charges if you had used your physical credit card to make purchases.

Does Samsung Pay charge any transaction fee?

Like famous digital wallets, such as Apple Pay and Google Pay, Samsung Pay does not charge any additional charges from users. However, you will have to pay the fees applied by your card issuer.

You do not need to pay for subscribing to Samsung Pay. In addition, you do not need to bear additional costs while paying with Samsung Pay.

Which One is the Winner

Apple Pay vs Google Pay vs Samsung Pay comparison suggests that users must decide which option works best for them according to their needs and preferences. The preference of users also depends on circumstances and mobile devices.

Moreover, all these three digital payment services take advantage of NFC (near-field communication) technology, enabling users to avail of the contactless payments feature. Besides, users can get other exciting benefits like rewards and loyalty programs when using their payment systems.

On the other hand, Apple Pay is available to Apple users specifically. The same goes for Android users, too, as they can use Google Pay on their devices hassle-free.

Samsung Pay is accessible to Samsung users in particular. Android users can also opt for Samsung Pay but must use Android 6.0 (Marshmallow) on their devices.

Through Samsung Pay, you can use another salient feature known as magnetic secure transmission (MST). The feature lets you use numerous payment terminals.

As far as Apple Pay goes, you can make payments through the Apple Watch. To make payments on Mac computers, you will use the Safari browser.

But Apple Pay and Samsung Pay do not allow you to send money to friends and loved ones. Android users can send money to loved ones and friends via Google Pay.

Still, deciding which payment option, including Apple Pay, Google Pay, and Samsung Pay, is the clear winner is not easy. That’s because circumstances, personal needs, and preferences come into play again.

Frequently Asked Questions

- How many people prefer to use Apple Pay worldwide?

Statista says over 500 million users have activated Apple Pay on their iPhones. Remember, these are the latest statistics from a leading global data and business intelligence platform. Currently, Apple Pay has a subscriber base of 507 million globally.

- Is Samsung Pay part of Samsung Wallet?

Samsung Pay is now known as a Samsung Wallet in some countries, including the US, UK, France, and Germany. Thus, you can update your existing Samsung Pay app to continue enjoying salient features of Samsung Wallet in a new way altogether.

- Was Android Pay launched before Apple Pay?

No, Android Pay, now called Google Pay, was launched in 2018. Apple Pay is a pioneer in the field of mobile payment apps because the service was launched in 2014.

However, both payment options share common features and functionalities, as you need to provide your credit card information when using these services.